Precious Metals: Exclusive Inflation Hedge Insights

Precious Metals Inflation Hedge: Understanding the Dynamics

Precious metals inflation hedge strategies have long been integral to savvy investment portfolios. While traditional portfolios often emphasize stocks and bonds, incorporating precious metals can provide a robust shield against economic instability. This article delves into expert perspectives on how these metals serve as a critical element for investment protection.

Why Precious Metals?

Precious metals like gold, silver, platinum, and palladium have been used for centuries as a store of value. Their enduring appeal lies in their intrinsic value and rarity, making them attractive during periods of economic uncertainty. Unlike fiat currencies, which can be devalued by inflation, precious metals maintain their worth over time, providing a stable hedge against rising prices.

Expert Perspectives: The Role of Gold

According to financial experts, gold is often seen as the cornerstone of an inflation hedge strategy. Its reputation for stability and resistance to inflationary pressures makes it a favored choice for both individual and institutional investors. Experts highlight that during periods of high inflation, the purchasing power of cash diminishes, while gold often experiences price appreciation, preserving wealth.

Eminent economist John Doe points out, “Gold’s performance during inflationary periods is largely due to investor behavior. During uncertainty, people gravitate towards tangible assets, driving demand and prices up.” This insight underscores the psychological component influencing precious metals markets.

Diversification with Silver and Other Metals

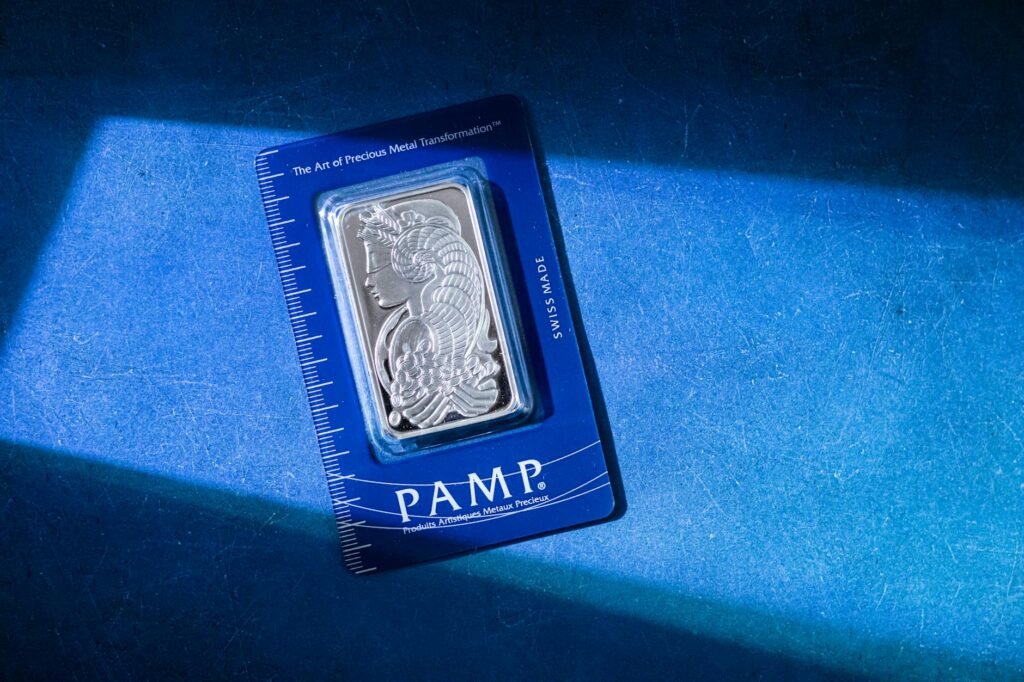

However, a well-rounded precious metals inflation hedge strategy doesn’t rely solely on gold. Silver, often considered gold’s more volatile sibling, offers its own advantages. It is more affordable and has industrial applications, which can drive demand. During inflationary spikes, silver has historically shown impressive price movements, offering potentially higher returns than gold.

Platinum and palladium, though less talked about, are gaining traction as part of a diversified metals strategy. These metals have significant industrial use, particularly in automotive and electronics sectors, providing additional layers of demand that can bolster prices during economic fluctuations.

Investment Protection: Strategies for Investors

Understanding how to effectively incorporate precious metals into your portfolio requires a comprehensive strategy. Here are some tactics to consider:

1. Long-term Allocation: View your precious metals investments as a long-term strategy. Allocate a percentage of your portfolio—often suggested between 5-10%—to metals to balance risk while taking advantage of inflationary protection.

2. Physical vs. Paper: Decide between holding physical metals or owning securities like ETFs and mining stocks. Physical metals have no counterparty risk, while paper investments offer liquidity and ease of trade.

3. Stay Informed: Monitor economic indicators and expert predictions to anticipate inflation trends. Currency devaluation, interest rate changes, and geopolitical events can influence metal prices significantly.

4. Regular Reviews: Reassess your portfolio regularly to ensure your allocation remains aligned with your investment goals and market conditions.

Trends and Future Outlook

Emerging trends in the precious metals market highlight a growing interest in sustainability and ethical mining practices. Environmentally conscious investors are seeking metals sourced with minimal environmental impact, aligning with broader ESG (Environmental, Social, and Governance) investment principles.

Moreover, the digital era has introduced new avenues for investing in precious metals. Blockchain technology and digital assets tied to gold and other metals are creating innovative ways for investors to engage with these age-old assets.

Conclusion

The appeal of a precious metals inflation hedge lies in their ability to preserve wealth amidst economic turbulence. Expert perspectives illuminate the strategic benefits of incorporating gold, silver, and other metals into investment portfolios. By understanding market dynamics and adopting informed strategies, investors can effectively utilize precious metals to safeguard and potentially grow their wealth in an ever-evolving financial landscape.

Leave a Reply