Precious Metal Market News: Exclusive Investor Insights

Precious Metal Market News: Understanding the Dynamics

Precious metal market news is a crucial source of information for investors who are keen to navigate the complexities of gold, silver, platinum, and palladium investments. This market is vital for both traders and long-term holders because of its correlation with economic stability and inflation trends. Here’s an exploration of what’s influencing the market, along with exclusive insights for investors.

Investor Insights on Market Trends

Volatility and geopolitical factors continue to shape the precious metals market. Gold, often seen as a safe haven during economic downturns, tends to attract investors seeking stability. Recent trends highlight a renewed interest in precious metals as inflation fears loom and currency valuations fluctuate. Investors should pay keen attention to economic reports and central bank policies as these significantly impact metal prices.

Countries with large gold reserves, such as China and Russia, regularly influence market dynamics. With central banks adjusting interest rates to control inflation, gold prices often respond with increased volatility. Silver, with its industrial applications, also reflects some of these behaviors but is often more sensitive to technological advancements and green energy trends.

Trend Analysis: What’s Driving the Market?

In recent years, the precious metal market has been influenced by several key trends:

1. Green Energy Initiatives:

The push towards greener technologies impacts metals like silver and platinum significantly. Silver’s role in solar panels and platinum’s use in catalytic converters have driven demand from industries aiming to reduce carbon footprints.

2. Cryptocurrency’s Role:

Digital currencies have introduced an alternative asset class that competes with traditional metals for investor attention. While some see Bitcoin as the “digital gold,” it has not fully replaced the physical precious metals due to its own volatility and regulatory concerns.

3. Investment Demand Surge:

With global uncertainties, there’s been a surge in demand for gold ETFs and bullion as investors seek more tangible assets. The physical ownership of these metals provides a sense of security amid fluctuating market conditions.

4. Economic Recovery Post-Pandemic:

As economies recover from the pandemic, the supply and demand for metals like palladium, used in the automobile sector, have seen significant fluctuations. This recovery phase will continue to influence pricing strategies and investor decisions.

Strategic Tips for Investors

1. Diversify Portfolios:

Instead of focusing solely on gold, consider diversifying with a mix of silver, platinum, and even lesser-known metals like palladium. Each metal has unique market drivers and advantages.

2. Monitor Political Tensions:

Geopolitical events can cause sharp changes in demand and supply. Staying informed about international relations can help predict potential market disruptions.

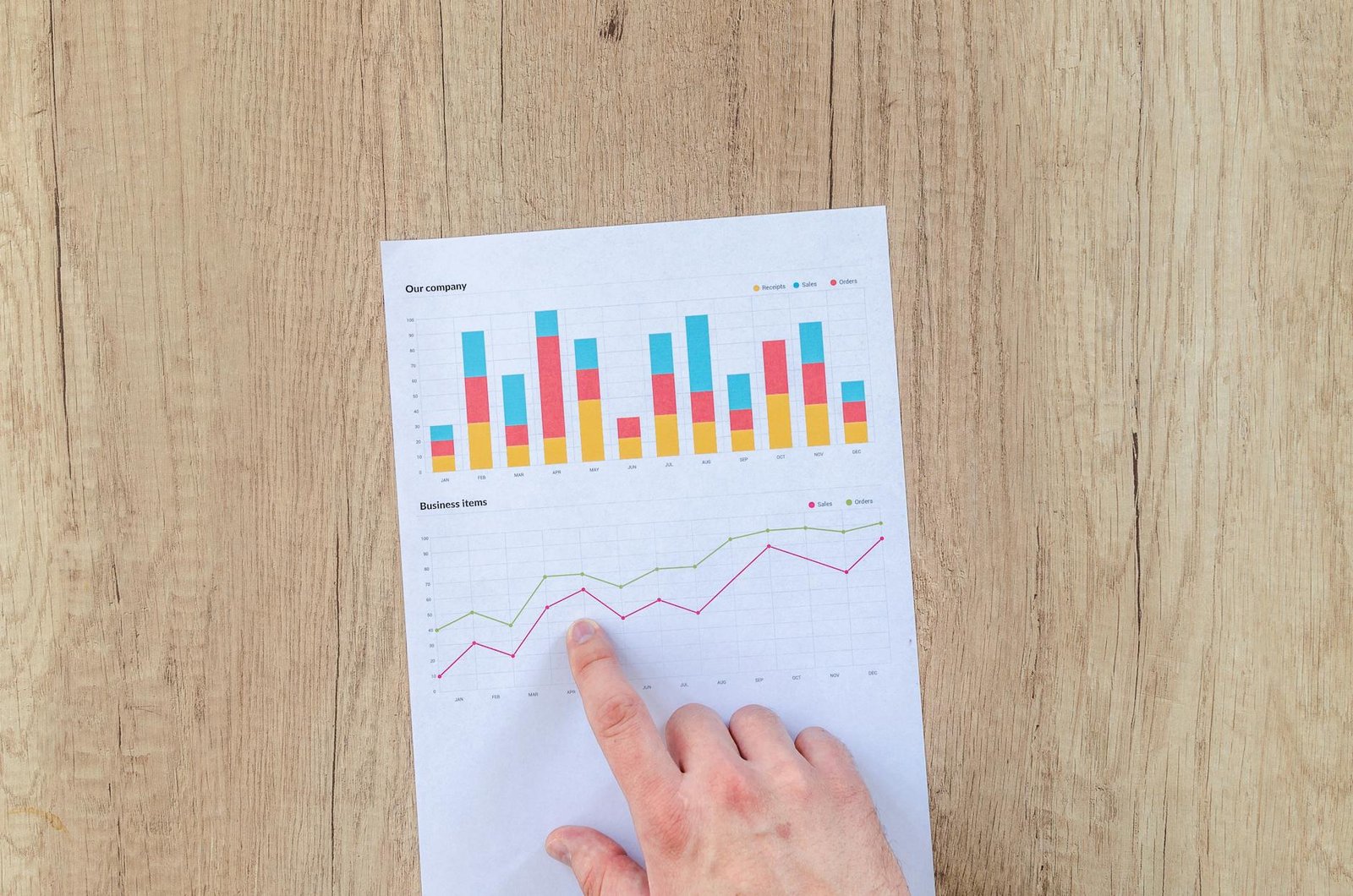

3. Regular Market Analysis:

Subscribe to reliable sources for precious metal market news. Regular updates and expert analyses can provide insights that aren’t immediately obvious and help with informed decision-making.

4. Long-term vs. Short-term:

Define your investment strategy. Those looking for short-term gains must remain vigilant to price swings, while long-term investors can typically weather market volatility in pursuit of overall asset growth.

Future Outlook

As global economies continue to evolve, the demand for precious metals is expected to remain robust. Technological advancements and renewable energy commitments will likely drive silver and platinum’s appeal further. Moreover, as governments deliberate on economic stimulus measures, precious metals will continue to serve as a hedge against inflation, making them attractive to cautious investors.

Conclusion

Staying updated with precious metal market news and understanding investor insights can significantly enhance investment strategies. By recognizing the factors driving market trends, investors are better equipped to make informed decisions that align with their financial goals. Whether it’s through diversification, strategic analysis, or keeping an eye on global trends, the precious metals market continues to offer myriad opportunities for savvy investors.

Leave a Reply