Emotional Investing Gold: Discover Its Stunning Benefits

Emotional Investing Gold: A Path to Stability and Fulfillment

Emotional investing gold can be a fascinating strategy that draws on more than just financial calculations. It intertwines economic stability with psychological satisfaction, offering investors a unique journey through the world of tangible assets. This article delves into the psychological appeal of investing in the precious metal and how it stands apart in today’s fast-paced financial market.

Understanding Emotional Investing in Gold

Investing with emotion might sound counterintuitive in the analytical world of finance, but it’s a concept that resonates with many investors. Emotionally investing in gold is driven by personal connections to the metal, whether cultural, historical, or aesthetic. This kind of investing taps into the deep-rooted allure of gold, with its enduring legacy as a symbol of wealth, prestige, and security.

Gold’s status as a tangible asset offers psychological comfort, creating a strong emotional bond for investors. In a digital age where assets are often invisible and intangible, holding gold provides a sense of physical security and permanence. This connection is powerful, even beyond the rational benefits of diversification and hedging against inflation.

Tangible Assets Psychology: Beyond Numbers

The psychology of tangible assets plays a crucial role in emotional investing gold. Tangible assets, especially like gold, provide a sense of control and reliability. During times of economic uncertainty, this becomes an anchor for many investors seeking refuge from the volatility of paper assets.

The psychological appeal of holding gold physically is rooted in the human desire for stability and certainty. Gold, unlike paper currency or digital assets, is immune to default or hacking. This reliability nourishes a sense of security, permitting investors to sleep better at night, knowing that their wealth is both real and safeguarded.

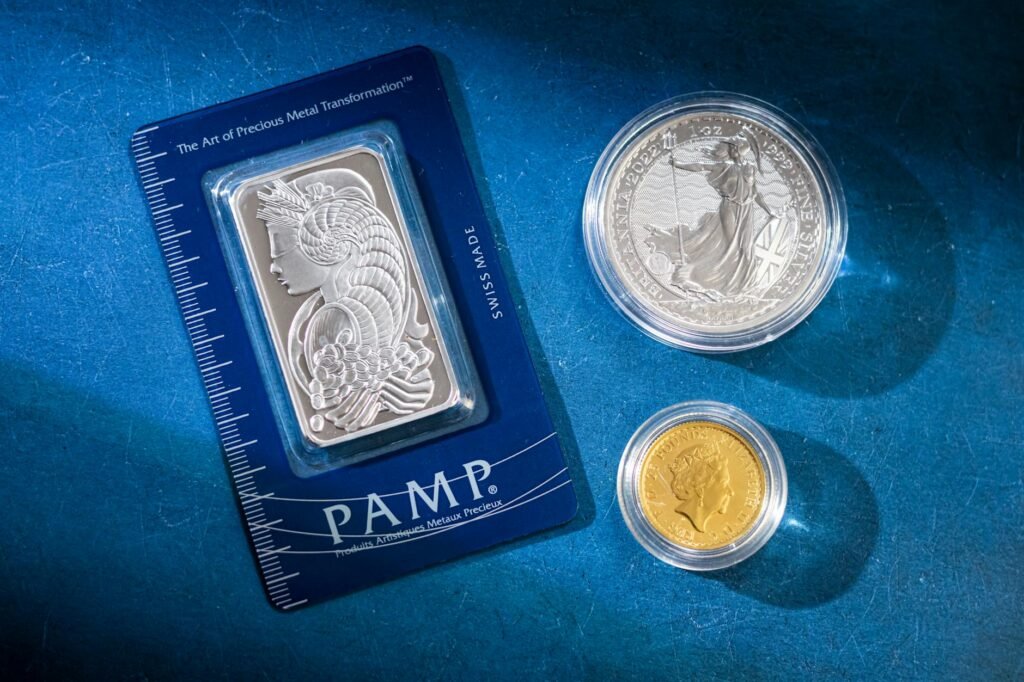

Moreover, having gold in one’s possession invokes a visceral experience. The weight and shine of gold coins or bars offer a satisfaction that no digital number can replicate. This tangible connection triggers a deep-set satisfaction, enriching the experience of investment.

Precious Metal Passion: An Emotional Investment

Gold is much more than a financial asset; it embodies a mystique that draws passionate collectors and investors alike. The passion for precious metals is driven by a combination of beauty and intrinsic value, making gold an emotional and aspirational investment.

Collectors and investors might find themselves enamored not only by the metal’s monetary worth but by its artistic and historical significance. Coins and bars often commemorate important events or figures, providing a narrative that enhances their allure. For many, investing in gold transforms into a pursuit of legacy and honor, fueled by a passion for the stories and artistry it embodies.

The connection to gold can also be deeply personal, tied to family traditions or cultural heritage. Many families invest in gold as a means of preserving wealth through generations, ensuring financial security for their descendants. This adds an emotional layer to the investment, enriching its significance beyond mere market value.

Financial and Emotional Benefits

Investing emotionally in gold offers a dual reward system. Financially, gold is a seasoned safe haven. It acts as a hedge against inflation and currency fluctuations, and its scarcity ensures it retains value over time, often increasing when other markets falter.

Emotionally, gold offers investors peace of mind. During turbulent market phases, the steadfast presence of gold provides reassurance, buffering against stress and uncertainty. The personal stories and sentiments tied to owning gold elevate its value, making it more than just an asset, but a hallmark of legacy and wealth.

Conclusion: A Balanced Approach

Emotional investing in gold beautifully intertwines the rational benefits of a stable asset with psychological gratification. While traditional investment strategies revolve solely around monetary gain, emotional investing in tangible assets like gold offers a holistic approach, addressing both economic and emotional well-being.

For those considering adding gold to their portfolio, understanding its multi-dimensional role can enhance not only financial security but also personal satisfaction. It’s about crafting a legacy, safeguarding wealth, and experiencing the joy that comes with owning a timeless piece of history.

Leave a Reply