Coin Investing Strategies: Uncover Best Secrets Today!

Coin Investing Strategies: Uncover Best Secrets Today!

Coin investing strategies have long intrigued and captivated both novice and seasoned investors. The allure of precious metals, combined with the potential for high returns, makes coin investing a fascinating financial endeavor. Whether you’re looking into bullion or collectible coins, understanding the nuances of this investment approach can significantly enhance your portfolio.

Why Coin Investing?

Investing in coins provides a unique opportunity to combine tangible assets with potentially high profit margins. Unlike stocks or bonds, coins offer real, physical investments that can hold or increase their value over time. Economic downturns often see a rise in the value of precious metals as they are considered a safe haven, making coins an attractive option for those seeking stability.

Bullion vs. Coins: Understanding the Difference

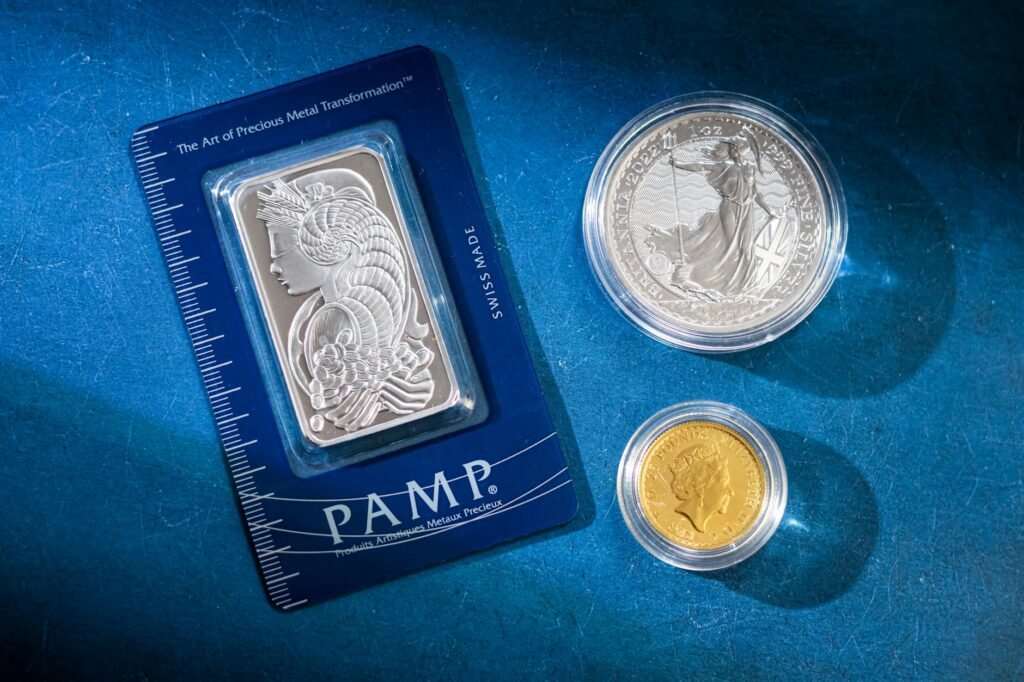

One essential aspect of coin investing strategies is distinguishing between bullion and collectible coins. While both have intrinsic value, their investment potential can differ significantly.

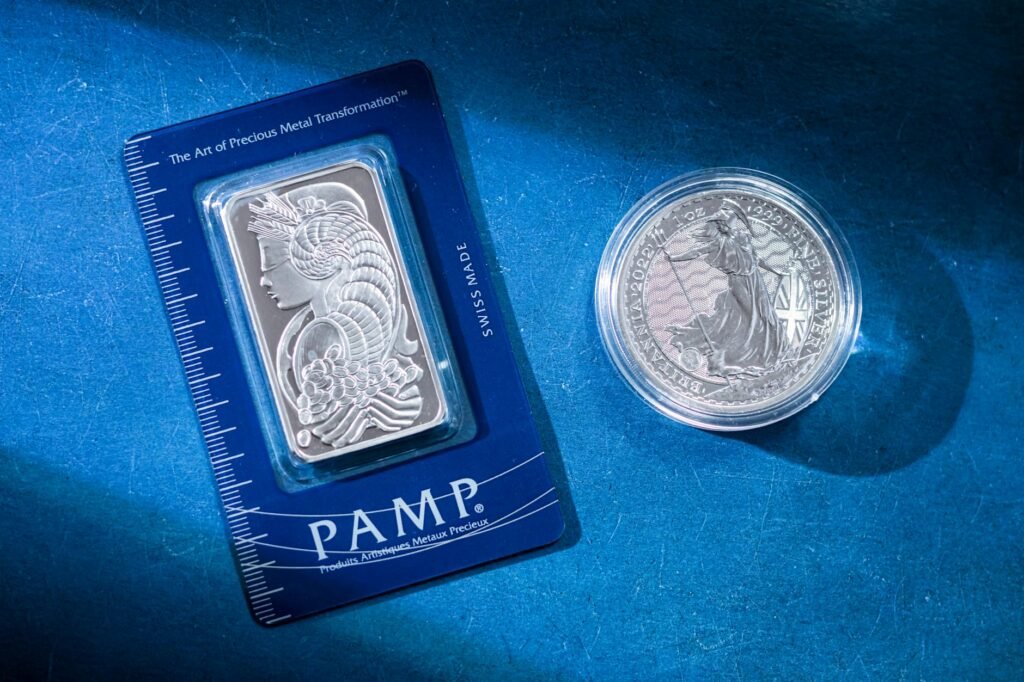

Bullion Coins

Bullion coins are primarily valued by their metal content. Gold and silver bullion coins are often chosen for their purity and weight and are typically issued by governments. These coins are an excellent way to invest in precious metals without the need to delve into the complexities of numismatics (the study or collection of currency). Gold bullion coins such as the American Gold Eagle or Canadian Maple Leaf are popular choices for those seeking a straightforward investment.

Collectible Precious Metals

On the other hand, collectible coins, or numismatic coins, derive value from their rarity, historical significance, and condition, beyond their metal content. These can include antique coins, rare mint errors, or limited edition series. Investing in these requires a deeper understanding of the market, but the potential rewards can be substantial due to their rarity.

Developing Effective Coin Investing Strategies

Successful coin investing requires a blend of research, analysis, and strategic planning. Here are some key strategies to consider:

1. Diversify Your Portfolio

Diversification is a fundamental principle in investing, including the realm of coins. Combining bullion with collectible coins can spread risk and tap into different value streams. While bullion offers reliability, collectibles can provide considerable appreciation potential.

2. Pay Attention to Market Trends

Staying informed about market trends is crucial. Economic indicators, geopolitical events, and changes in market demand can significantly impact coin values. Subscribing to industry publications or participating in coin collecting forums can provide valuable insights and forecast market shifts.

3. Verify Authenticity and Condition

Whether investing in bullion or collectibles, ensuring authenticity is paramount. Working with reputable dealers and obtaining certifications from trusted institutions like the Professional Coin Grading Service (PCGS) or Numismatic Guaranty Corporation (NGC) can promote confidence in your investments. The condition of coins (known as “grade”) can also heavily influence their value, particularly for numismatic coins.

4. Consult Experts

If you’re new to coin investing, consulting experts can be an invaluable step. Coin dealers, investment advisors, and numismatic experts can provide guidance and help tailor strategies to align with your financial goals.

Investing in Collectible Precious Metals

Diving into collectible coins offers the opportunity to appreciate history and culture while investing. However, it requires thorough research and patience. Understanding the historical context, rarity, and demand for specific coins can lead to substantial returns. Collectors often find joy not only in the potential profits but also in the historical narrative associated with coins.

Final Thoughts

Coin investing offers a diverse and enriching landscape for investors. Whether through securely investing in bullion or exploring the vibrant world of collectible precious metals, informed strategies can lead to both emotional satisfaction and financial gain. The key is to remain informed, embrace diversification, and keep learning as the market evolves. With these strategies, you can uncover the best secrets of coin investing and potentially enjoy lucrative returns.

Leave a Reply